Unveiling the secrets to financial freedom, Dave Ramsey Chapter 6 Answers empowers you with the knowledge and strategies to conquer debt. Dive into the practical insights of the debt snowball method, unlocking a path towards financial stability and peace of mind.

Embark on a transformative journey as we delve into the fundamentals of debt management, guiding you through every step of the debt snowball process. Discover the power of prioritizing debts, budgeting effectively, and implementing strategies that will keep you motivated and on track.

Introduction to Chapter 6: Debt Snowball Method: Dave Ramsey Chapter 6 Answers

The debt snowball method is a strategy for paying off debt that involves focusing on paying off the smallest debt first, regardless of its interest rate. This method can be effective for people who have multiple debts and want to get out of debt quickly.

Advantages of the Debt Snowball Method

*

- Provides a sense of accomplishment as you pay off debts one at a time.

- Can help you stay motivated to continue paying off debt.

- Can help you avoid paying unnecessary interest on your debts.

Disadvantages of the Debt Snowball Method

*

- Can take longer to pay off debt than other methods, such as the debt avalanche method.

- Can result in paying more interest overall than other methods.

Understanding Your Debt Situation

To effectively tackle your debt, it’s crucial to have a clear understanding of your financial situation. Creating a debt inventory is the first step towards gaining this clarity.

If you’re looking for answers to Dave Ramsey’s Chapter 6, you’re not alone. Many people have found success by following Ramsey’s financial advice. For those of you who are also interested in the TN FFA State Convention 2023, I’ve included a link for more information.

TN FFA State Convention 2023 Coming back to the topic, Dave Ramsey’s Chapter 6 is a great resource for anyone looking to improve their financial situation.

Creating a Debt Inventory

A debt inventory is a comprehensive list of all your outstanding debts. It should include the following information for each debt:

- Creditor’s name

- Account number

- Balance

- Interest rate

- Minimum payment

- Due date

Creating a debt inventory provides a snapshot of your overall debt situation and allows you to identify areas that need attention.

Categorizing and Prioritizing Debts

Once you have a complete debt inventory, it’s helpful to categorize your debts into different types. Common categories include:

- Credit cards

- Personal loans

- Student loans

- Mortgages

- Car loans

Prioritizing your debts is essential for effective debt repayment. The debt snowball method recommends focusing on paying off the smallest debt first, regardless of its interest rate. This strategy helps build momentum and motivation as you see your debts gradually decrease.

Tracking Debt Payments and Progress

To stay on track with your debt repayment plan, it’s important to track your payments and progress regularly. This can be done through:

- Online budgeting tools

- Spreadsheets

- Debt repayment apps

Regularly reviewing your progress will help you identify areas where you can improve your repayment strategy and stay motivated to reach your debt-free goal.

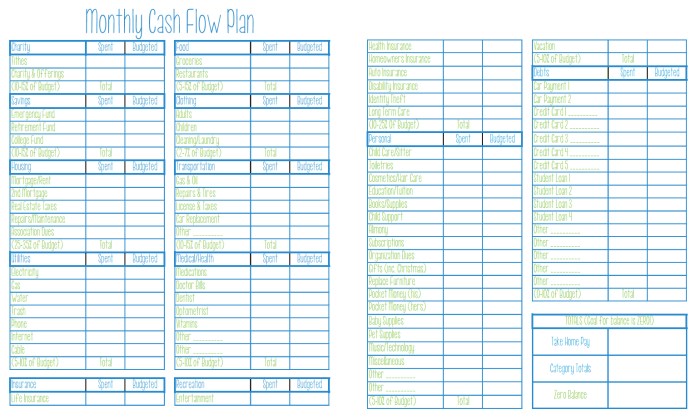

Budgeting for Debt Repayment

Budgeting is a crucial step in debt repayment, as it provides a roadmap for allocating your income to prioritize debt payments and other essential expenses.

To create a budget that supports debt repayment, follow these steps:

- Track your income and expenses:Note down all sources of income and every expense, no matter how small.

- Categorize expenses:Group expenses into categories such as housing, food, transportation, and debt payments.

- Prioritize debt payments:Allocate funds to debt repayment as a top priority, focusing on paying off high-interest debts first.

- Reduce unnecessary expenses:Identify areas where you can cut back on non-essential spending to free up more funds for debt repayment.

- Monitor your budget:Regularly review your budget to ensure you’re sticking to the plan and make adjustments as needed.

Effective Budgeting Techniques, Dave ramsey chapter 6 answers

Consider the following effective budgeting techniques:

- Zero-based budgeting:Allocate every dollar of income to specific categories, including debt repayment.

- Envelope budgeting:Divide cash into envelopes for different expense categories, including debt payments, to limit spending.

- Online budgeting tools:Utilize budgeting apps or software to track expenses, set financial goals, and stay on track.

Implementing the Debt Snowball Method

The debt snowball method is a simple yet effective way to pay off debt. It involves focusing on paying off the smallest debt first, regardless of its interest rate. Once the smallest debt is paid off, you move on to the next smallest debt, and so on.

Step-by-Step Process

- List all of your debts, including the balance, interest rate, and minimum payment.

- Order your debts from smallest to largest, regardless of interest rate.

- Make the minimum payment on all of your debts except the smallest one.

- Put any extra money you have towards the smallest debt.

- Once the smallest debt is paid off, move on to the next smallest debt and repeat the process.

Examples

Let’s say you have the following debts:

- Credit card 1: $1,000, 15% interest

- Credit card 2: $2,000, 12% interest

- Personal loan: $3,000, 10% interest

Using the debt snowball method, you would focus on paying off the credit card with the smallest balance first, which is $1,000. You would make the minimum payment on the other two debts and put any extra money you have towards the $1,000 debt.

Once the $1,000 debt is paid off, you would move on to the $2,000 debt and repeat the process.

Staying Motivated

Staying motivated to pay off debt can be difficult, but there are a few things you can do to help yourself:

- Set realistic goals. Don’t try to pay off all of your debt overnight. Focus on paying off one debt at a time.

- Track your progress. Seeing how much you’ve paid off can help you stay motivated.

- Reward yourself for your successes. When you pay off a debt, treat yourself to something small to celebrate.

Additional Tips for Debt Repayment

Beyond the debt snowball method, consider these additional tips for effective debt repayment:

Seek Professional Help

If struggling to manage debt, don’t hesitate to seek professional assistance from a credit counselor or financial advisor. They can provide personalized guidance, help create a budget, and negotiate with creditors on your behalf.

Utilize Support Options

Various resources and support options are available for individuals struggling with debt, such as:

- Nonprofit credit counseling agencies

- Debt management plans

- Debt consolidation loans

Explore these options and choose the one that best suits your situation.

FAQ Resource

What is the debt snowball method?

The debt snowball method is a debt repayment strategy that involves focusing on paying off the smallest debt first, regardless of its interest rate, while making minimum payments on other debts.

How do I create a debt inventory?

To create a debt inventory, list all your debts, including the balance, interest rate, and minimum payment for each debt.

What is the role of budgeting in debt repayment?

Budgeting is essential for debt repayment as it allows you to allocate funds to debt payments while managing your other expenses.

What are some additional tips for debt repayment?

Additional tips for debt repayment include seeking professional help if needed, automating debt payments, and staying motivated by tracking your progress.