Delve into the captivating world of accounting with the Financial & Managerial Accounting 16th Edition PDF, a comprehensive resource that unravels the intricacies of financial and managerial accounting. Embark on a journey through the fundamental concepts, techniques, and practices that shape the world of business and finance.

This meticulously crafted guide provides a solid foundation in financial accounting, empowering you with an understanding of assets, liabilities, equity, revenue, and expenses. Explore the principles and standards that govern financial reporting, such as the accrual basis and the matching principle, gaining insights into the ethical responsibilities of accountants and the role of accounting information systems in managing financial data.

Financial Accounting Concepts

Financial accounting is the process of recording, classifying, and summarizing financial transactions to provide information that is useful for decision-making. The fundamental concepts of financial accounting include:

- Assets:Economic resources that are owned or controlled by a company.

- Liabilities:Obligations that a company owes to others.

- Equity:The residual interest in the assets of a company after deducting its liabilities.

- Revenue:The amount of money earned by a company from its operations.

- Expenses:The costs incurred by a company in generating revenue.

Financial accounting principles and standards are used to ensure that financial statements are accurate and reliable. Some of the most important principles and standards include:

- Accrual basis:Transactions are recorded when they occur, regardless of when cash is received or paid.

- Matching principle:Expenses are matched to the revenues they generate.

Managerial Accounting Techniques

Managerial accounting is the process of providing financial information to managers to help them make informed decisions. Managerial accounting techniques include:

- Cost-volume-profit analysis:A technique used to analyze the relationship between costs, volume, and profit.

- Budgeting:A process of planning and controlling financial resources.

Managerial accounting techniques can be used to improve business performance by helping managers to:

- Understand the costs of their operations.

- Make informed decisions about pricing and production.

- Control costs and improve profitability.

Financial Statement Analysis

Financial statement analysis is the process of using financial statements to assess a company’s financial health and performance. Financial statement analysis techniques include:

- Financial ratios:Ratios that compare different financial statement items to each other.

- Trend analysis:Comparing financial statement data over time.

- Peer analysis:Comparing financial statement data to that of other companies in the same industry.

Financial statement analysis can be used to:

- Assess a company’s liquidity, solvency, and profitability.

- Identify trends in a company’s financial performance.

- Compare a company’s financial performance to that of its competitors.

Accounting for Specific Industries

Different industries have unique accounting practices and challenges. Some of the most common industry-specific accounting issues include:

- Healthcare:Accounting for healthcare costs, such as patient care and medical supplies.

- Manufacturing:Accounting for inventory, production costs, and equipment.

- Non-profit organizations:Accounting for donations, grants, and other non-profit revenue sources.

Accounting principles are applied differently in different industries to reflect the unique nature of each industry.

Ethics in Accounting: Financial & Managerial Accounting 16th Edition Pdf

Accountants have a responsibility to maintain objectivity, confidentiality, and professional integrity. Ethical issues in accounting include:

- Conflicts of interest:Accountants should avoid situations where their personal interests conflict with their professional responsibilities.

- Confidentiality:Accountants should not disclose confidential client information without the client’s consent.

- Professional integrity:Accountants should uphold the highest standards of professional conduct.

Ethical accounting practices are essential for maintaining the integrity of the accounting profession and ensuring the accuracy and reliability of financial information.

Accounting Information Systems

Accounting information systems (AIS) are computer systems that are used to manage financial data. AIS can help accountants to:

- Record and track financial transactions.

- Generate financial reports.

- Control costs and improve efficiency.

There are many different types of AIS, ranging from simple spreadsheets to complex enterprise resource planning (ERP) systems. The type of AIS that is right for a particular company will depend on its size, complexity, and specific needs.

Current Trends in Accounting

Emerging trends in accounting include:

- Artificial intelligence (AI):AI is being used to automate accounting tasks, such as data entry and financial analysis.

- Blockchain technology:Blockchain technology is being used to create secure and transparent accounting systems.

These trends are having a significant impact on the accounting profession and business practices. Accountants who are able to adapt to these trends will be in high demand in the future.

FAQ Explained

What is the purpose of financial accounting?

Financial accounting provides information about a company’s financial performance and position to external users, such as investors, creditors, and government agencies.

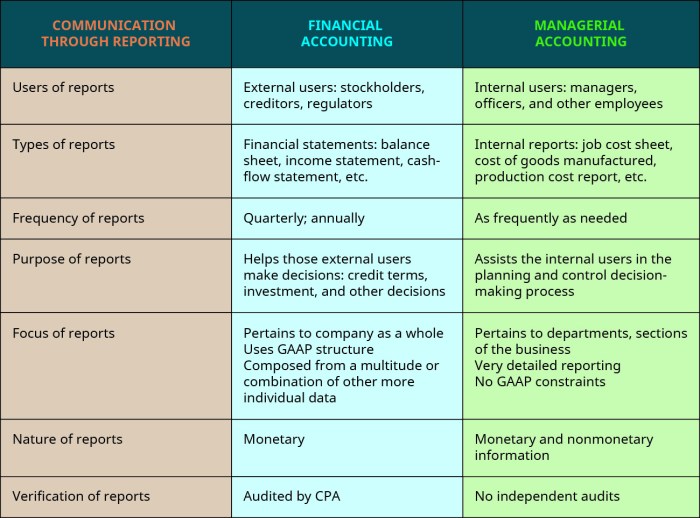

How does managerial accounting differ from financial accounting?

Managerial accounting focuses on providing information to internal users, such as managers and employees, to support decision-making and planning.

What are the key principles of financial accounting?

The key principles of financial accounting include the accrual basis, the matching principle, and the going concern assumption.

What is the importance of financial statement analysis?

Financial statement analysis helps users assess a company’s financial health, performance, and risk.

What are the ethical responsibilities of accountants?

Accountants have a responsibility to maintain objectivity, confidentiality, and professional integrity in their work.